Income Tax in India: Understanding Income, Relief, and How It Affects You

Income tax is one of the most important financial obligations for every earning individual or entity in India. It directly impacts how much of your earnings you take home and how much goes to the government to fund public services. If you’re looking for information on income tax relief, the basics of incometax, or simply want to understand how income gets taxed, this blog will guide you.

What is Income Tax?

Income tax is a tax imposed by the government on the income earned by individuals, Hindu Undivided Families (HUFs), businesses, and other entities. The tax collected is used for infrastructure development, public welfare programs, healthcare, education, and more.

In India, the Income Tax Act, 1961, governs all aspects of income tax, from defining taxable income to specifying relief measures and penalties for non-compliance.

How is Income Taxed?

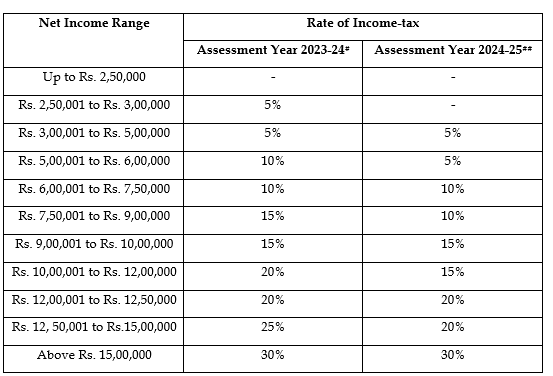

Income is taxed based on the income slabs set by the government. The slab system ensures progressive taxation, meaning higher incomes are taxed at higher rates.

For individual taxpayers, the slabs differ based on age:

- Individuals below 60 years.

- Senior citizens aged 60–80 years.

- Super senior citizens aged above 80 years.

The income tax slabs are revised during the Union Budget announcements, so staying updated is essential.

Types of Income Taxable in India

The government categorizes income into five main heads:

- Income from Salary

This includes all earnings received as salary or wages, such as basic pay, allowances, and bonuses. - Income from House Property

Rental income from property is taxed under this head, but deductions like municipal taxes and a 30% standard deduction are available. - Income from Business or Profession

Profits earned by self-employed individuals, freelancers, or businesses fall under this category. - Income from Capital Gains

Earnings from selling assets like stocks, mutual funds, or property are taxed under capital gains. - Income from Other Sources

Any income that doesn’t fall into the above categories, like interest from savings accounts, lottery winnings, etc.

Income Tax Relief Measures

The government provides various relief measures to reduce the tax burden on taxpayers. These include:

- Section 80C Deductions

Investments in instruments like Public Provident Fund (PPF), National Savings Certificate (NSC), and Life Insurance Premiums qualify for deductions up to ₹1.5 lakh. - Section 80D for Health Insurance

Deductions on health insurance premiums provide relief for medical expenses. - Standard Deduction for Salaried Individuals

Currently set at ₹50,000, this deduction reduces the taxable salary income directly. - HRA and LTA Exemptions

House Rent Allowance (HRA) and Leave Travel Allowance (LTA) are partially or fully exempted, reducing your taxable income. - Rebate Under Section 87A

If your taxable income is less than ₹5 lakh, you can avail of a rebate of up to ₹12,500, effectively nullifying your tax liability. - Deductions on Home Loan Interest (Section 24)

Interest paid on home loans can be claimed as a deduction up to ₹2 lakh per year.

Common Mistakes to Avoid While Filing Income Tax Returns

- Not Reporting All Income

Freelancers and salaried individuals sometimes miss declaring interest income or side earnings, which could attract penalties. - Incorrect Bank Details

Ensure your bank details are accurate to receive refunds without delay. - Delaying Tax Filing

Late filing results in penalties, so always file returns on or before the deadline.

Claiming Wrong Deductions

Claim only those deductions you are eligible for, as false claims may lead to scrutiny.

Benefits of Paying Income Tax

While paying taxes might feel like a burden, it has several benefits:

- Nation Building

Your taxes contribute to infrastructure, public services, and welfare programs. - Loan and Visa Approvals

Regular filing of Income Tax Returns (ITR) makes it easier to get loans and visa approvals, as they act as proof of income.

Avoidance of Penalties

Paying taxes on time helps you avoid interest and penalties under the Income Tax Act.

The Role of Income Tax in India’s Economy

Income tax is a major revenue source for the government, funding initiatives like healthcare, education, and rural development. Moreover, compliance ensures transparency and accountability in the system.

By offering income tax relief through exemptions and deductions, the government encourages savings and investments, fostering economic growth.

Steps to File Your Income Tax Return (ITR) Online

- Collect Necessary Documents

Keep Form 16, TDS certificates, and investment proof ready. - Log In to the Income Tax Portal

Visit the official e-filing portal of the Income Tax Department. - Choose the Correct ITR Form

The type of ITR form depends on your income source. - Fill and Submit the Form

Enter your details, verify with an OTP, and upload the form.

Verification

Post-filing, verify your return through Aadhaar OTP or by sending a signed copy of ITR-V to CPC, Bengaluru

Future of Income Tax in India

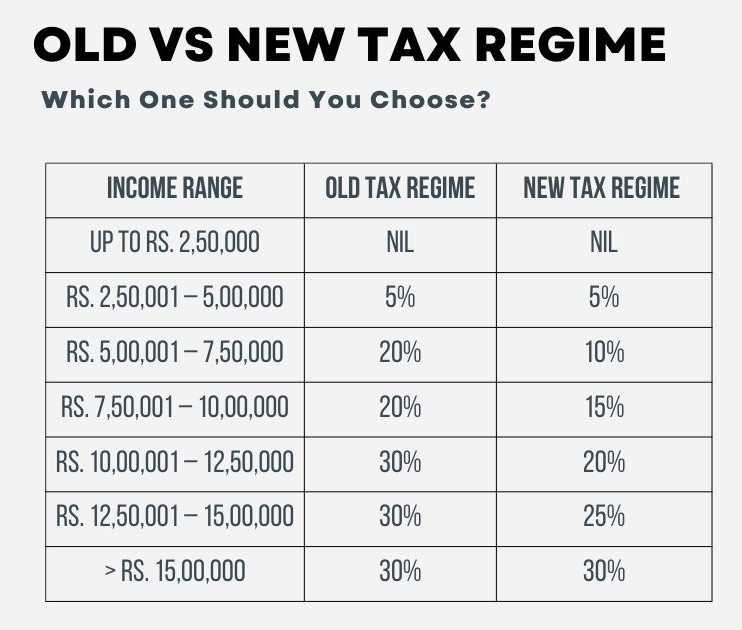

The government continuously revises policies to simplify incometax procedures and enhance compliance. Recent initiatives like the New Tax Regime provide taxpayers with the option to forgo exemptions and opt for lower tax rates, offering flexibility based on individual preferences.

The digitization of the tax filing process, coupled with AI-driven systems for assessing returns, ensures a smoother and more efficient tax experience.

Conclusion

Understanding income tax isn’t just a financial responsibility—it’s a way to contribute to the nation’s development. Whether you’re looking for ways to maximize income tax relief or simply want to file your returns correctly, staying informed is key. Always plan your investments and expenses wisely to make the most of the exemptions and deductions available under Indian tax laws.

By being proactive and responsible, you can make income tax filing a stress-free process while ensuring your hard-earned money works for you and the country.